(click above image for video commentary)

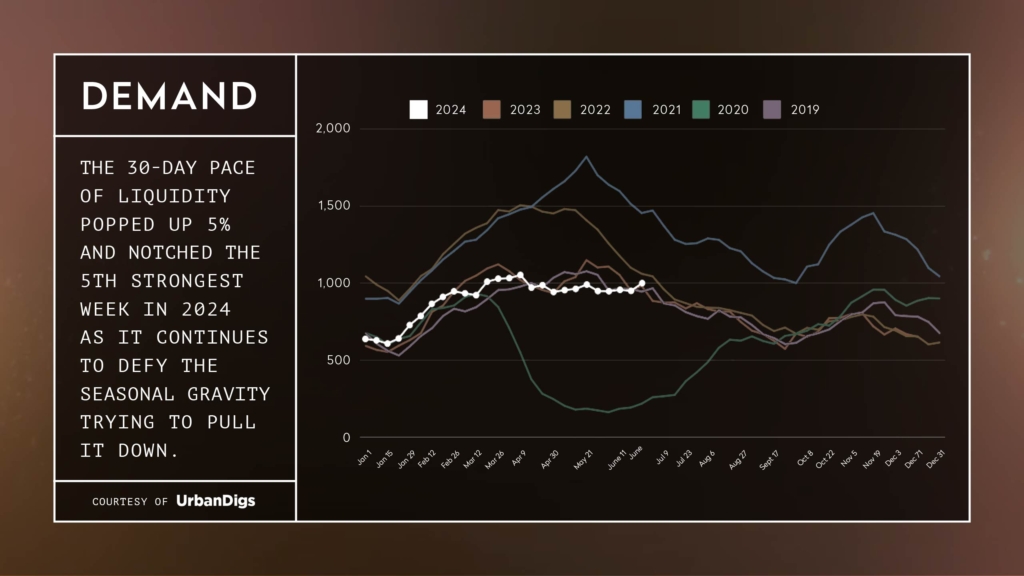

In the last week of June buyers stole Mark Twain’s sentiment that “reports of my death are greatly exaggerated,” as deal activity jumped by 5% over the previous week, the penultimate week of the quarter. An anomaly it may be, but again it shows precisely what I noted last month, the relationship between deal volume and interest rates is extremely acute. The slightest easing in rates we saw in the week prior, seemingly, generated that bump in volume.

This was also helped by a slight increase in the number of sellers acquiescing to more moderate offers. Looking forward, the Fed also now looks keen to realize its first rate cut in September. So, if you’re a real buyer get ahead of an impending wave which will likely land fully by Spring 2025. It feels like being under cover at an outdoor event as it rains; some people don’t care and they’re out there standing in the rain (metaphorically, those are our current buyers), some start to slowly come out as the rain eases, and then finally, as the skies clear, everyone comes out. For the market, the worst of the storm has passed, but it’s still raining and slowly people are coming out, tired of being restricted and they just want to get on with it. Those waiting for “perfect” conditions will sadly miss the whole event.

This was also helped by a slight increase in the number of sellers acquiescing to more moderate offers. Looking forward, the Fed also now looks keen to realize its first rate cut in September. So, if you’re a real buyer get ahead of an impending wave which will likely land fully by Spring 2025. It feels like being under cover at an outdoor event as it rains; some people don’t care and they’re out there standing in the rain (metaphorically, those are our current buyers), some start to slowly come out as the rain eases, and then finally, as the skies clear, everyone comes out. For the market, the worst of the storm has passed, but it’s still raining and slowly people are coming out, tired of being restricted and they just want to get on with it. Those waiting for “perfect” conditions will sadly miss the whole event.

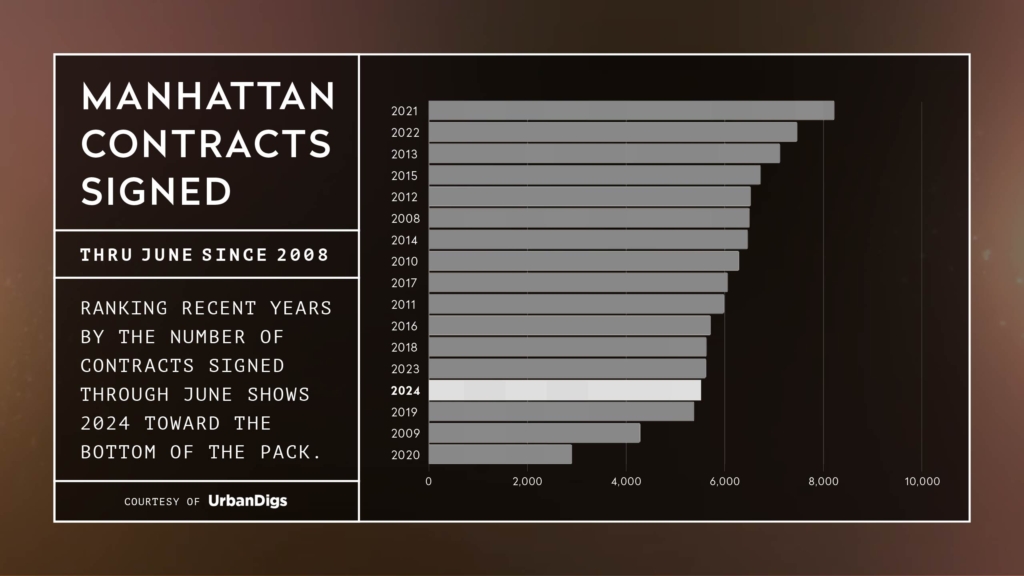

Something else that’s on my mind?…Perspective!

It’s all about perspective. See the chart below, look where our deal volume is relative to past years. Except for the rubber band snap-back that we experienced immediately following Covid in 2021 and into 2022, our deal volume is down, way down compared to certain years prior to 2018.

This downward trend was exacerbated by the litany of policy driven initiatives…well-meaning initiatives which grossly (naively) miscalculated the results. On a personal level we experienced the elimination of SALT deductions (2017) and a hike in mansion and transfer taxes (2019). On a more macro level, we have seen the dissolution of the 421a tax abatement for developers at a time when we truly need to incentivize development. The proponents of eliminating these incentives thought they were taking from the big (greedy) developers and leveling the playing field. The intent was to provide more housing for the less affluent; but instead finds us in a place where we are barely seeing any construction whatsoever, particularly housing geared toward that particular sector…making the city (by the simple supply and demand principle) even less affordable.

This downward trend was exacerbated by the litany of policy driven initiatives…well-meaning initiatives which grossly (naively) miscalculated the results. On a personal level we experienced the elimination of SALT deductions (2017) and a hike in mansion and transfer taxes (2019). On a more macro level, we have seen the dissolution of the 421a tax abatement for developers at a time when we truly need to incentivize development. The proponents of eliminating these incentives thought they were taking from the big (greedy) developers and leveling the playing field. The intent was to provide more housing for the less affluent; but instead finds us in a place where we are barely seeing any construction whatsoever, particularly housing geared toward that particular sector…making the city (by the simple supply and demand principle) even less affordable.

“The affordability crunch has become particularly stark in New York where asking rents have surged 33% from pre-pandemic levels and the median sales price has climbed 24%.” – From Bloomberg’s article NYC’s Worsening Apartment Shortage Threatens to Push Costs Higher (July 2, 2024)

The disincentivization regarding development has clearly deepened an already existing housing crisis. Further, the grand slate of rental laws passed in 2019 have squeezed the viability of the small landlord, leaving most so strapped they cannot re-invest into their properties.

Bloomberg went on to say: “…building has failed to keep up with demand. From 2010 to 2023, the number of jobs in the city rose by 25%, outpacing the city’s housing stock growth of 7%, according to the New York State Department of Labor and US Census Bureau data.”

The people supporting all of these misguided initiatives are playing small ball; they’re not considering that this is a long game. We must look to the future and plant seeds for growth. YES, the developers are going to make money…lots of money; but who cares, as long as everyone is better off. We are better off when we’re all thriving. Imagine…more development provides for more jobs and more housing, more housing creates a more resilient and healthy community, a safer community and a safer community makes for more transactions i.e. more revenue for the city…much more revenue for the city. Heck, we could use the money. And I KNOW…I’m oversimplifying the issues, but we need to modify our perspective…our mindset. Let’s go New York!!!

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.