I have some clients waiting for a crash, or prices to go down; this is a low probability, especially at the current pace of deal volume. Please wish me luck…and patience, as I will be showing these dear client’s apartments for the next 5 years until they quit or realize they can’t afford it anymore. What always follows is a manifestation of I “could’ve, should’ve…ah, I didn’t”. This might sound like tough love, but it’s literally the reality that we, as brokers, see and talk about every day. For some buyers, this is an inside scoop of what your broker has really been trying to delicately explain to you for years now. One colleague of mine said, “look, if it was that great of a deal, it would never hit the market or leave this office, as one of us would seize that opportunity.”

Buying real estate is about 1) creating a home (and there is no value that can be put on that); 2) diversification and 3) creating wealth. The third part takes time; it should be viewed similarly to the concept of “dollar cost averaging.” The earlier you get in, the more TIME you have to build that wealth; you can begin to chip away at paying off that asset and building equity…and that equity, again…over time, appreciates. In the end, probability would indicate those who get in early will have made the better bet; it’s the age-old concept of the early bird gets the worm.

So, before many pack up for summer let’s see where we are. Oddly, some properties sell, and some don’t, for no particular reason at times; consequently, there is a bit of randomness in the market, and it has served up a bit of confusion. This is a marketplace we’ve not seen before. In 25 years, I’ve seemingly not experienced so many confusing and critical economic and political forces influencing the purchasing process. The customary “rules of thumb” we’ve seen in prior markets aren’t necessarily holding true. The market is muddled.

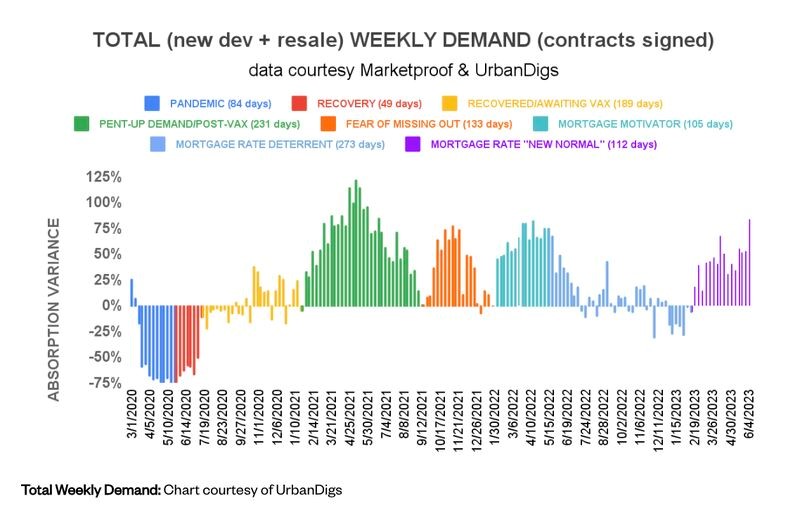

Regardless, April’s lull made for a delayed seasonal surge in contracts in May. Like it or not, we are in a “new normal” of interest rates and pricing. Interest rates have doubled, and prices have come down/moderated 5-10% depending upon which segment of the market you are in. Those who have accepted this new reality are succeeding in this marketplace and deals are happening…many deals. So we must identify the cycle we are in right now. I have found no better chart* to depict where we are at the moment than the one below by Marketproof and Noah & John from UrbanDigs.

“Showing Market Pulse for any bedroom configuration in All Manhattan for all prices. Courtesy UrbanDigs

* I credit Jared Antin for bringing this chart to my attention.

Remember that nearly 60% of our deals right now are all-cash purchases. Not only are these buyers not as affected by the higher interest rates, they are simultaneously taking advantage of the lower prices. They are the primary drivers of demand, meaning the market is not waiting for those who are sitting on the sidelines. Interestingly, the new buyers who have entered the marketplace have a psychological advantage to those who have been looking for more than a year; they are far less jaded. These new buyers never witnessed 3% interest rates; they don’t even understand what that means. The old buyers, however, look as if they have been through a battle; they are battered and depressed, as the doubling of interest rates has made homes that were once a consideration, no longer affordable.

It’s impossible to predict the future, but we are optimistic. Yes, rates are higher than they were, but fair. They will likely remain at their current level for some time, before falling in 2024, when everybody will be jumping in. Keep in mind that the greatest barrier into the Manhattan market is not the price; it’s the competition. The fact is opportunity exists right now; you simply have to employ the right strategies for your own unique circumstances.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.