We are experiencing a market in transition where both buyers and sellers are trying to identify their respective roles in this play, which at the moment reflects more improvisation and entropy. The waves of negative and, at times, conflicting economic data coupled with unresolved Fed moves and volatile financial markets have brought uncertainty. The predictable result is waning demand and lower prices; however, it has proven to be a bit more random than that.

Prices have moderated, but not fallen off the cliff for various reasons. New York is not a secondary market, it is a primary market…a “need housing” market, meaning that, although demand might wane, it will not likely plummet. This is evidenced by the fact that the most robust activity has taken place in the below $3M range where the bulk of the populous exists; the greatest slowdown has been in the luxury sector, which represents a smaller portion of the entire marketplace and a sector which includes far more discretionary purchases. The rental market has been hot and substantially expensive, serving as a buoy for the sale market, as a better option. Likewise, the pace of Fall inventory has been a bit more moderate than most expected. So as this past summer’s deals begin to close and reveal the softening in values, prices will be required to follow suit; however, the aforementioned reasons will mute that decline.

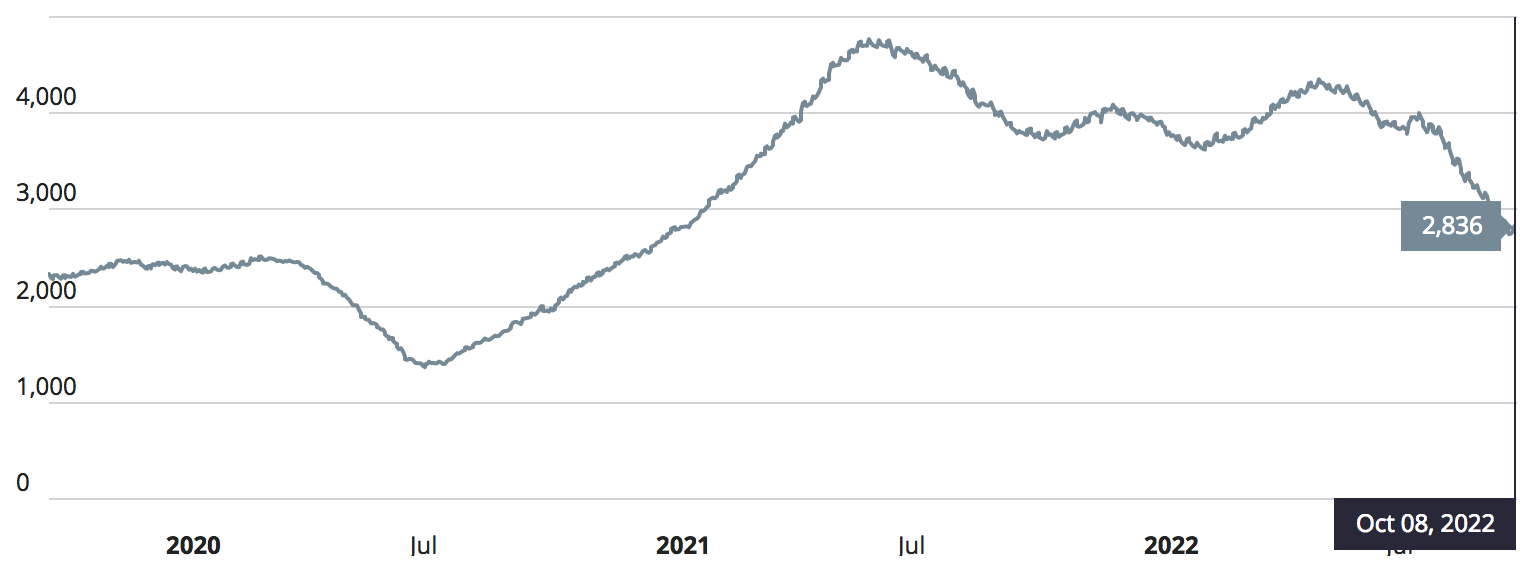

Pending Sales

The number of in contract listings that are “pending” a closing date. Listings in contract more than 6 months are excluded. Consider that two years ago at this same time (pre-covid) pending sales were at 2,295; so we are still substantially higher than back then.

The number of in contract listings that are “pending” a closing date. Listings in contract more than 6 months are excluded. Consider that two years ago at this same time (pre-covid) pending sales were at 2,295; so we are still substantially higher than back then.

Although we are off last year’s record highs, market activity remains measured. Activity has been a bit scattered, with some segments outperforming others and vice versa, with no distinct rationality…reflecting the “improvisation” I mentioned at the onset. Generally though, the downward pressure on pricing from inflation and interest rates is slowing the pace and subduing sentiment. Note, the drastic change in interest rates will have more of a negative impact on the less expensive price ranges, where financing is more prevalent. Historically, it is precisely at this moment in the real estate cycle that buyers have been able to get the best deals. Because the most recent downturns were experienced with relatively low interest rates, this cycle may not yield the same level of dislocation/opportunity simply because interest rates are higher than we have seen in nearly 15 years and inflation is higher than we have seen in nearly 40 years. Regardless, it still may very well be the best buying opportunity we will see for many years. Time will tell.

As I have said, more so than price dynamics, I think the greatest barrier to entry into the Manhattan market is competition. With many indecisively sitting on the sidelines, competition has moderated; fewer people on the dance floor allows for more room to maneuver. Buyers should consider this time period before it gets palpably busier in the Spring. Those indecisive buyers cannot hold off forever though; they will eventually have to execute their plan. Again, Manhattan is generally not a market of choice; it is a market of need. People need housing and life demands change: people get married, people get divorced, kids are born, kids leave the house, people change jobs, people retire etc. The slower activity now will serve to mount future demand, which most likely will begin to unleash in the late Winter/early Spring. The dance floor will be full and could end up feeling like a phone booth.

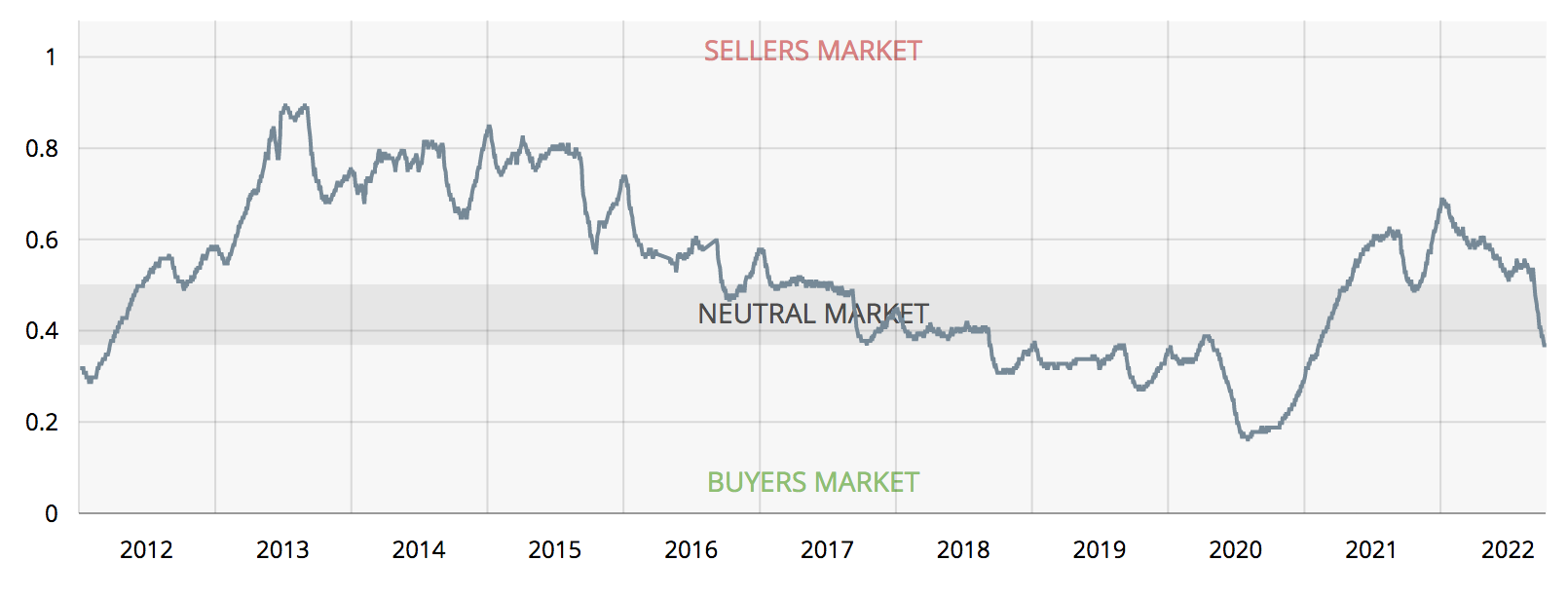

Market Pulse

Above Charts: Courtesy UrbanDigs

We need to collect this new information daily and transpose it onto the historical cycles/results that we already know and try to plan accordingly. All of us have divergent needs and goals, so there is no one-size-fits-all approach. Please contact me to discuss anything and everything…inflation and interest rate expectations, inventory, pricing, timing, the rental market, preparedness etc.

As you know, I always say two things: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.

Do you want access to ALL Manhattan’s listings? The REAL ones?

Click below:

“Connect” with me, as CitySnap was created to present REAL information, provided by the original sources. Manhattan’s the most comprehensive search engine for residential real estate. Where the information is actually REAL and provided by the original sources. Join me!