Dear Subscriber,

Welcome to the third edition of the “Upper West Side Real Estate Market Bulletin”, a monthly digital newsletter that covers the state and direction of our local residential real estate market.

It features three unique aspects:

- Focus on our local Upper West Side residential real estate market;

- Identification and evaluation of the principal forces that drive our market; and

- Plain and simple language hospitable to our lay readership.

Market Summary

Because of legitimate concerns about high inflation, high interest rates and political uncertainty our market has been languishing in a state of caution as reflected in lower than historical average prices and sales volumes. While it’s too early to say, Biden’s “Inflation Reduction Act” is likely to perk up optimism about the economy, global warming, health care and inflation. Of course, at this point timing is moot, but it would not be surprising to see our real estate market reflect more positivity.

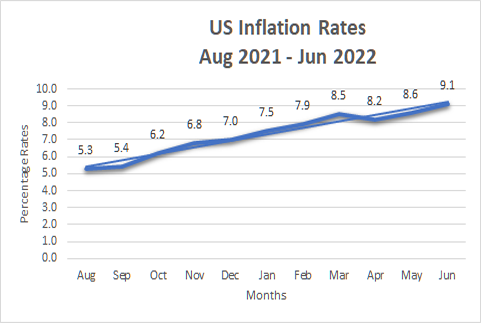

Inflation

The national inflation rate has skyrocketed in the past year. The costs of food, gas and oil are forcing households to divert funds they normally might have applied to mortgages and down payments to these now pricier essential commodities. The demand for housing will likely fall as, consequentially, will housing prices and sales.

Covid’s disruption of supply side distribution channels continues to manifest in inflationary price levels. Alleviation of these inflationary pressures appears to be slower than hoped for, sustaining historically high rates and challenging economic growth.

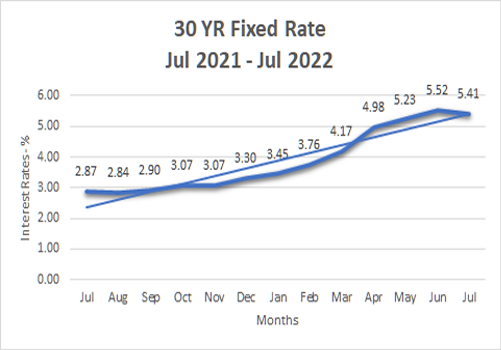

Mortgage Rates

Mortgage rates have virtually doubled over the past year, largely because the Fed, trying to stimulate a Covid-stricken economy, pumped excessive amounts of money into the economy, causing demand to exceed supplies and prices to escalate. Realizing its error, the Fed has reversed its easy money policy, but which yet has not been seen to ease mortgage rates, sustaining the drag on our real estate market.

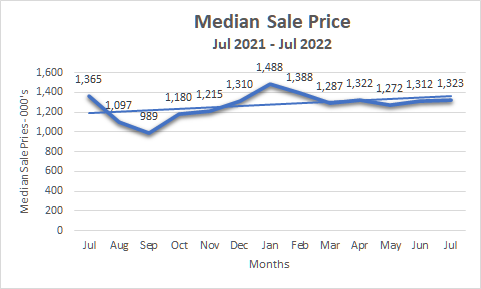

What do the tea leaves say?

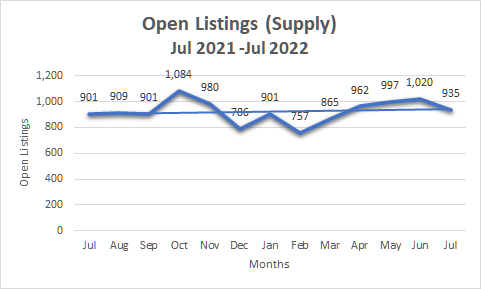

For our purposes, the tea leaves are graphs of UWS “Median Sale Prices” and the “Supply of Open Listings”. Both of these metrics indicate a continuing softness since the “Median Sale Price” hit an inflection point in February, following a downward trend since. July data confirms that trend.

And, what are you up to?

Are you considering buying or selling an apartment this year? If so, know that we’re facing a volatile economy that could shift at any moment, but this is not all bad news. Some very good deals can be scored in down markets providing that one is adequately prepared and resourceful.

If you’re interested in exploring more about this intriguing option, just click on the link below to review methods for identifying and transacting exceptional down market deals.

Thanks for your interest and stay tuned!

Data provided by Urban Digs