Regardless of omicron, with a new mayor, record Wall Street bonuses and the return of foreign buyers, there’s optimism in the air. As I said in December, I think 2022 will be a feast for properly priced properties. Strong demand will likely elevate these properties beyond face value.

The story in 2022 will be inventory and interest rates !!…the two “I’s” are back. As if with sunglasses though, we have yet to see how dilated they are. Soon enough the sun will rise on 2022 to reveal what is in store for us.

In 2021 we saw copious quantities of apartments come on the market, but because of extraordinary demand, we witnessed a methodical drop in overall inventory. The year began with approximately 7,200 listings for sale and ended below 5,000; that is a 30+% drop in inventory. And THIS is how we enter 2022.

Demand is expected to remain strong, but how many apartments will there be to sell? Opinions are mixed on how many new and back-on-the-market homes will become available. I believe we will have more than anticipated; though it will be mixed, lots in certain sectors and less-so in others. I also feel demand will remain overwhelmingly strong, especially because of two factors:

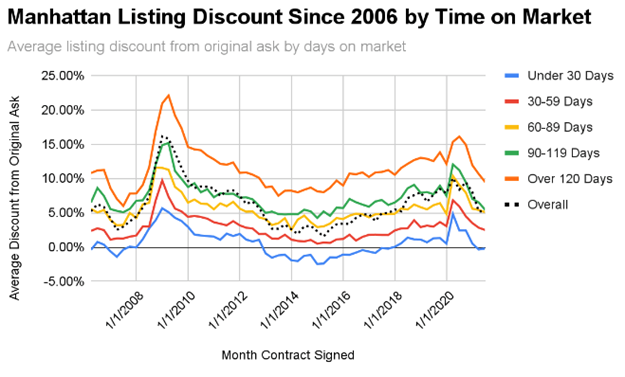

1) Over the past 15 months we have seen tremendous deal volume and an evaporation of the price discounts which prevailed during the heights of the pandemic; however, we have yet to see a measurable spike in prices. This means that the opportunity to buy at a fair price still exists.

2) The “relative” low interest-rate environment persist…(remember what I said back in November) “for now.” Like prices, however, they are creeping up, but have yet to go on a run that could (and may well eventually) temper demand. When rates do indeed make a material move upward they will have a moderating effect on market activity, as the hikes will have a tremendous impact on purchasing power [See Purchasing Power Analysis in the Mortgage section below]. As more and more buyers recognize this negative impact, urgency will certainly boost short term demand.

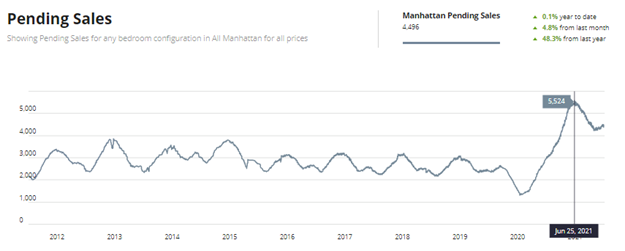

We are also hearing a lot about a slowdown in activity; that should not be misinterpreted to mean that we are in a down market. The slowdown has been an easing from the record breaking, frenzied, pace we saw in the middle of 2021, a pace that obliterated anything we saw prior (see chart above). With fewer apartments on the market, there will inevitably be fewer sales.

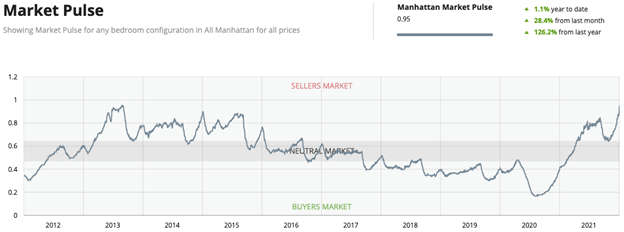

According to UrbanDigs current inventory is at 4730. The last time we saw inventory this low was four years ago, in January of 2018. The difference then, however, was far less demand. In January of 2018 there were approximately 2,356 pending deals while there were 4,732 units available for sale; meaning there was a “market pulse” of .49. Note: UrbanDigs defines market pulse as, “the ratio between pending sales (a measure of demand) and supply. An increase indicates a strengthening market. A decrease indicates a weakening market.” Right now the number of units available is virtually identical to 2018, at 4,730; however, the number of pending sales is 4,496. This translates to a market pulse of .95, which defines a very strong seller’s market (see chart below). We have not seen the market pulse metric this high since 2013, when supply had bottomed at around 3,000 homes for sale.

The good news for buyers in this cycle is that, we have likely bottomed for inventory. I believe we are going to see a fairly robust wave of property coming on the market; however, I also feel the competition for this product will be palpable. So as a buyer, you have to be prepared to engage; get pre-approved, secure an attorney and educate yourself by seeing every property you can. An experienced broker can help you assemble a team that fits “you” and can set a strategic agenda to get you home.

Sellers need to be equally equipped with an experienced broker who can properly position their property to get it sold efficiently. You want to come on the market and get it done expeditiously. Data repeatedly shows that time on the market erodes your value. The best deals, negotiated properly, yield the best results. See chart below.

Your best investment is often in the broker you choose. Find someone with experience, who you feel you can trust. Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them.

Roberto Cabrera

Roberto Cabrera

Licensed Real Estate Broker

Brown Harris Stevens

212.906.0554

Your City, Your Broker…

#YourCityYourBroker #NewYork #Manhattan