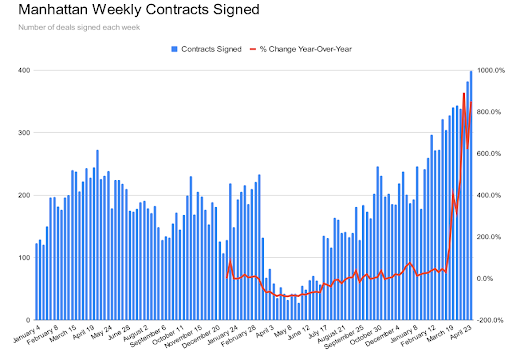

Last month we couldn’t believe the pace of contracts being signed. Well, it has accelerated and market activity continues to rage. Likely driven by pent-up demand and continued record low interest rates, we are seeing deal volume that is 26% higher than previous peak levels we saw in boom years, in the summers of both 2013 and 2015. There are currently 4,800 pending deals, with just over 1,600 contracts signed in the last month alone. We are also seeing record inventory numbers; over 2,200 listings have come on the market in the last month. That is 42% higher than the seasonal average pace of the past nine years* which includes 400 or more new listings per week for 8-9 weeks running. So as you can see, the faucets are on and the marketplace is flowing in a very healthy manner.

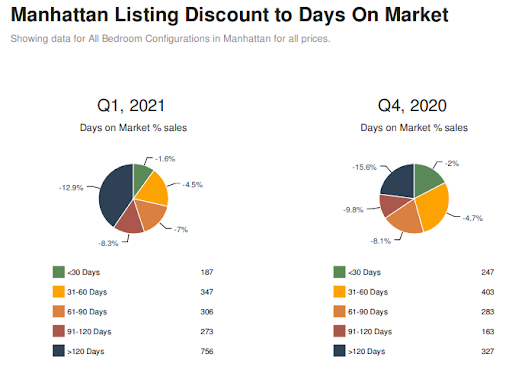

The result of this extraordinary activity has been a disappearance of “the covid discount.” When the pandemic hit and it felt like Armageddon, uncertainty and the resulting sentiment about Manhattan’s viability were grim. People expected fire sales and 50% discounts; those never materialized. We saw 8-25% discounts at the most, with a more moderate average discount being in the 10% range. But New York never stopped breathing, instead it rested, contemplated and has come raging back like never before. Like Oscar Goldman said about Steve Austin in the old Six Million Dollar Man introduction, he [Manhattan in this case] was “barely alive.” But that is not the end of the story; New Yorkers have since infused their spirit and resolve into this city. We are creating a new Manhattan, as Goldman continued, “better, stronger…faster.” And those Covid discounts have virtually disappeared, as we are seeing discounts far closer to the 2% range on average, with a growing number of properties experiencing bidding wars and above-asking-price deals.

The question, however, that everyone is asking is, “how much longer can this pace be sustained?” The answer lies in the basic supply and demand principle. Will supply outpace demand, meaning that escalating prices will moderate? Or will demand continue to increase and continue that upward pressure on pricing? The debate is out there. Most industry colleagues feel that demand may not moderate until late summer, as many people will, by then, know what the Fall holds for them. They will either be situated housing-wise, or at the very least be in the process of finalizing those plans. Beyond Fall, the feeling is that demand will remain robust, but less frenzied. Whereas we have seen deal volume outpace supply, you don’t even need that 1:1 ratio of supply and demand to see an escalation in pricing. Demand merely needs to be substantial.

Several factors to consider which will have varying effects on how the above plays out: Will interest rates remain low? A rise in rates could put a damper on demand, as it affects purchasing power; meaning sellers may not experience the steep price appreciation they desire. Continued normalcy will bring a regular flow of people back to the city…including foreign buyers, which have been nowhere to be seen in over a year. I have not yet personally seen it with my foreign clients, but I am hearing more and more anecdotal stories from my colleagues about their foreign buyers entering the fray. I expect to see the gates open on this front and that will boost demand. Taxes? SALT repeal? The Mayor’s race? All factors to be monitored.

Although the market activity has drastically increased, sellers need to price right-on-the-money, as the chart above depicts how time on the market erodes value.

Interestingly for buyers, see the dip in rates that just occurred (see Mortgages & Interest Rates” below)…down to 2.75% on a Jumbo 30 year fixed…opportunity abounds.

* Source UrbanDigs

“With the country continuing to reopen, New Yorkers returning to the city, and the vaccine rollout progressing rapidly, buyers are recognizing that now is the time to buy.”

– Gary Barnett, Founder and Chairman of Extell Development Company

Please join me on Thursdays at 4pm EST as I co-host a weekly zoom program called “Boroughs & Burbs” with my colleague John Engel. We talk about innumerable real estate issues and topics in New York and its suburbs which include CT, The Hamptons, NJ…we’ve recently even tapped into to see what’s been going on in Palm Beach, Miami and L.A.

Roberto Cabrera

Roberto Cabrera

Licensed Real Estate Broker

Brown Harris Stevens

212.906.0554

Your City, Your Broker…

#YourCityYourBroker #NewYork #Manhattan