I am often accused of saying it’s always a good time to buy. People read my newsletter and say, “you make it seem so rosy” or “you make it seem like it’s a good time to buy and then turn around and tell the sellers that it’s a good time to sell.” Well…there is truth in all of this and here’s why…at least here is my approach. Regardless of which side of the equation you are on (buying or selling), everyone’s goals are unique. Generally speaking, in life, if you just get on with it, you’re better off. I have learned that those who take action are the most successful. They may fail from time to time, but their victories supersede their failures and they are the winners. For some, perhaps that’s too general, or vague; so let’s break it down.

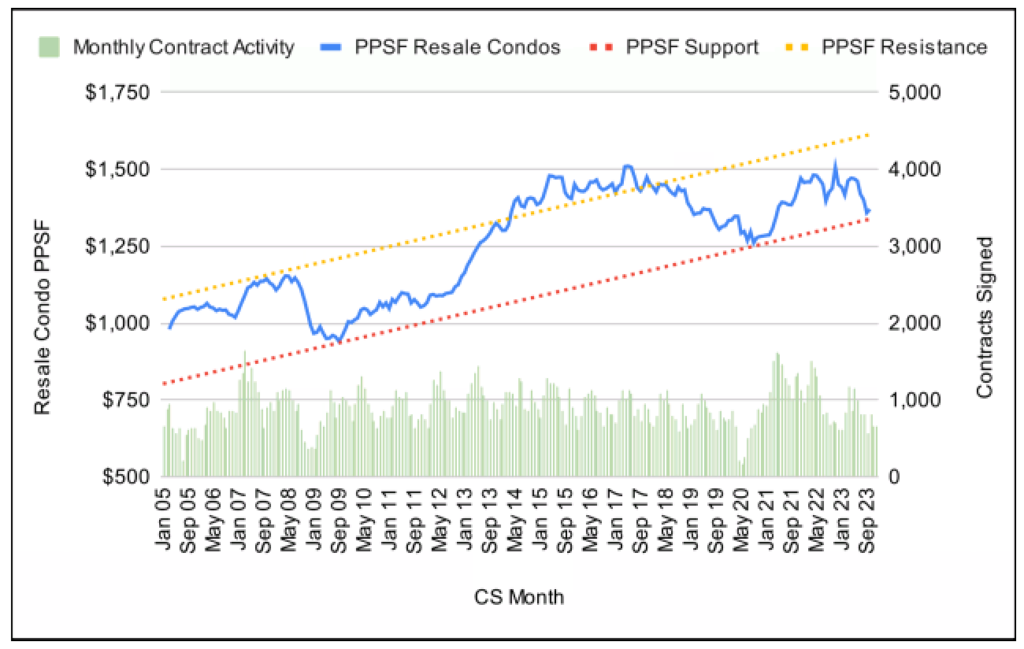

So let’s take buying first. Too many buyers try to “time” the market; this is a fool’s errand, as the market will change like the weather. When going from Winter to Summer the weather can get cold then hot and back again, innumerable times, depending on the day; it may even rain, sleet etc.….hard to predict. But generally, you know that as you gravitate into summer it’s going to get warmer. The market is the same, we have fluctuations from day to day and from seasonal-market-cycle to seasonal-market-cycle, but the trend is generally upward over longer periods of time. Meaning, if you are in it for the right time horizon and you experience “time in the market”, instead of “timing” the market, you are likely to fare far better in the end. Over the years you will have built equity in the property and not thrown money away on rent. I must caveat this with the assumption that these buyers are buyers seeking to create a “home”, which has its own unquantifiable and unique attributes and rewards. Buying property, as an investor, may assume completely different considerations, goals and time horizons and applies to a lesser degree to my premise. In Manhattan though, where rents are extremely high (the highest in the country), my premise remains acutely true.

Click on each respective chart to expand. Courtesy: UrbanDigs

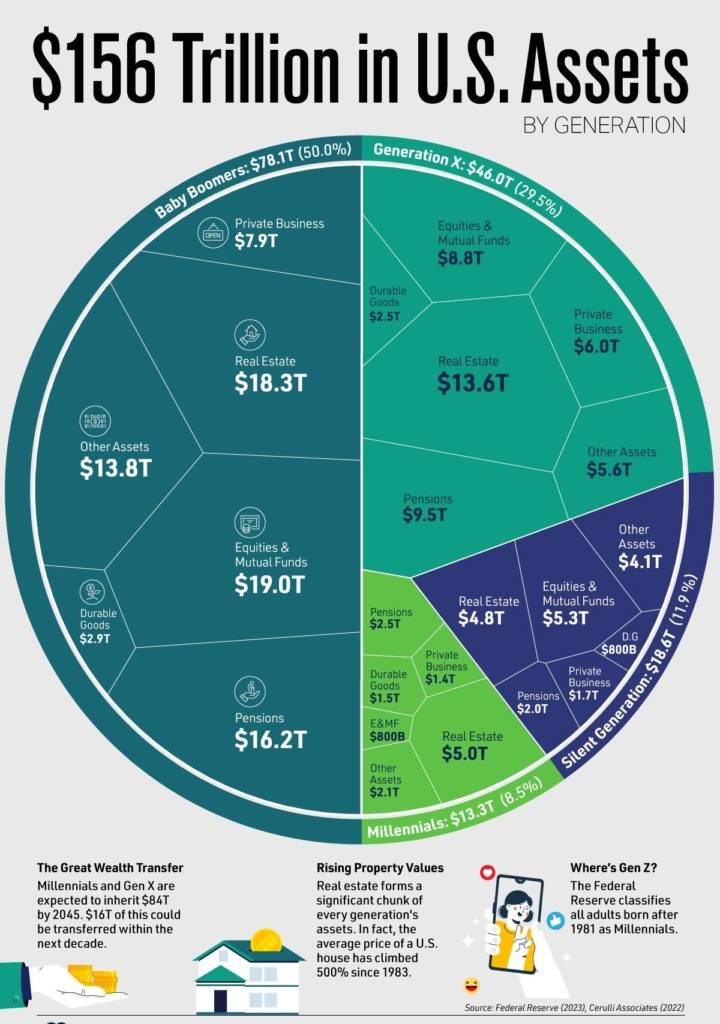

Now let’s put this into further context. Baby boomers have accumulated an overwhelming amount of wealth, much of it in the form of cash. To give you a sense of how much compare this: many estimates show that $5-6 Trillion were infused into the economy over the past three years…something we have never seen before. However, over the next 20 years, similar estimates state that $50-70 Trillion of wealth (~10X) will be handed over from Boomers to the younger generations (this will come in various forms, half of which will come as real estate and cash). Much of this wealth will be used to purchase what is the premiere asset class…real estate. Over the course of the next 15-20 years this cash, coupled with the desire to buy real estate, will be used not only to buy second and third homes, but homes for their kids and grandkids, as well investment properties. Now think, what will that level of demand do to prices (and hence, value) over the coming decades, especially if the scarcity of supply remains an issue?

Courtesy: Federal Reserve

We are still experiencing lingering effects of the 2008 housing crisis. The level of new construction, over the past decade and a half since, has been substantially lower than in the 90s and early 2000s. More recently the higher interest rates and government regulations have put even more pressure on this slowdown; thankfully there is light at the end of the tunnel for interest rates. Another factor is the wave of new buyers (mostly Millennials) who are entering the marketplace with every year that passes. This measurably higher demand, into the future, means that we may never have enough inventory to satisfy our needs.

Imagine if you bought a good property now (sooner rather than later)? The tide (in this case, the wave of transferred wealth) will raise ALL boats. It is precisely this which is the basis of my premise, that it’s almost always, “generally”, a good time to buy. You just need to find the right property for YOUR unique circumstances and time horizon.

In Manhattan, right now, we are seemingly bouncing along the bottom of the current cycle, a cycle in which we have witnessed a gradual decline in deal volume, as a consequence of demand, as a consequence of low inventory, as a consequence of a doubling of interest rates. Well, every rational indication is that interest rates have now stabilized and will eventually soften. So if you are STILL so inclined to “time” the market, because you simply cannot help yourself…particularly over the long haul, consider this extraordinary moment. Prices have softened some 8-10% in the last year and prices are reflecting a period somewhere between 2018-2019. Based on all the market fundamentals, particularly the low inventory levels* and the impending drop in interest rates, this level of regression will not likely repeat itself soon. So…consider the moment of where we are now at the beginning of 2024 and compare it to where we might be in 2030, 2035, 40, 45…

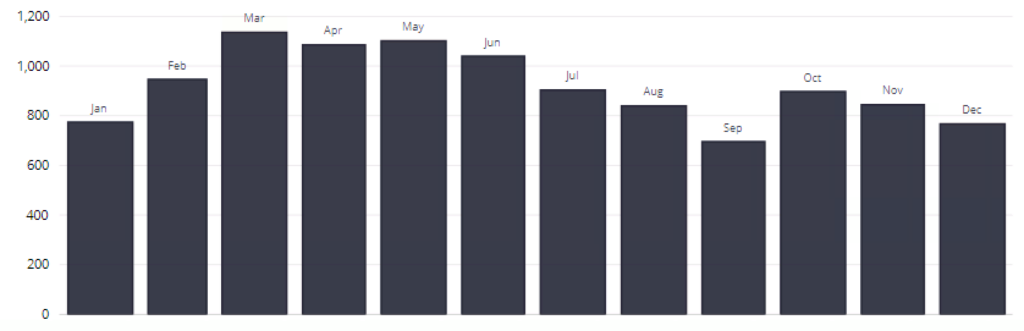

Now selling is a slightly different proposition, as you can typically capitalize on customary market cycles and fare better. That said, each seller has a super-agenda for why exactly they are selling. Depending upon what that is may determine how proactively you execute your plan. Are you selling because: you are upgrading? downsizing? got a new job in a different neighborhood or city?, need the money etc.?…the scenarios are infinite. Historically there are moments in the year that are better to sell than others, like mid/late February through May and the short market that reveals itself in the Fall, post Labor Day into the first or second week of November. Conversely, late summer and Thanksgiving into late January would be considered the least fruitful times.

OPTIMAL TIME TO LIST

Courtesy: UrbanDigs

Both scenarios are customarily determined by the number of buyers in the marketplace. With that information, you can be a bit more judicious about when you list; however, the point is still the same. In life, we are better off if we just get on with it. Some sellers painfully deliberate over every penny, when they would be better served and net a better result if they were to simply accept a solid outcome and move onto the next chapter. Some sellers put their lives on complete hold, while seeking a diminishing return to their bottom line. If they just get on with it, the unquantifiable rewards of living your life while attacking your life’s plan is what the doctor really ordered. When it is time to sell, one must consider the market conditions you have been given at that precise moment. Of course, it may very well pay off to wait several months or into the next year, but beyond that?…one risks eroding their emotional bottom line. You must maximize the market conditions you have been given, list at the right price and get it done.

So in both scenarios, it is about action and there is no better phrase that captures that than, “…there’s no time like the present.” So yes, I’m guilty as charged. But again, as mentioned at the onset of this monologue, this is a broad stroke. Please contact me so we can have actually have a dialogue about the specifics of your situation.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.