The long and short of it?… it’s a Buyer’s Market…“for now.” Remember that phrase?

It’s the beginning of a new year, and a ripe new cycle. I say this because it literally feels like the beginning of 2020, all over again. At that time, we had come off 4-5 years of slowing market activity, which was like the air slowly coming out of a balloon. When January came, we were on the verge of making the turn, and it started off great; the anticipation was buzzing among the brokerage community. It was going to be a helluva year…and then…boom, COVID. “The best-laid plans of mice and men often go awry.” Like then, there’s a buzz right now and the consensus is that we will finally pick up where we had left off then. Hopefully, this year’s optimism translates into something positive for all parties in the marketplace…buyers and sellers…as long as something catastrophic doesn’t happen, we are likely to see some robust activity.

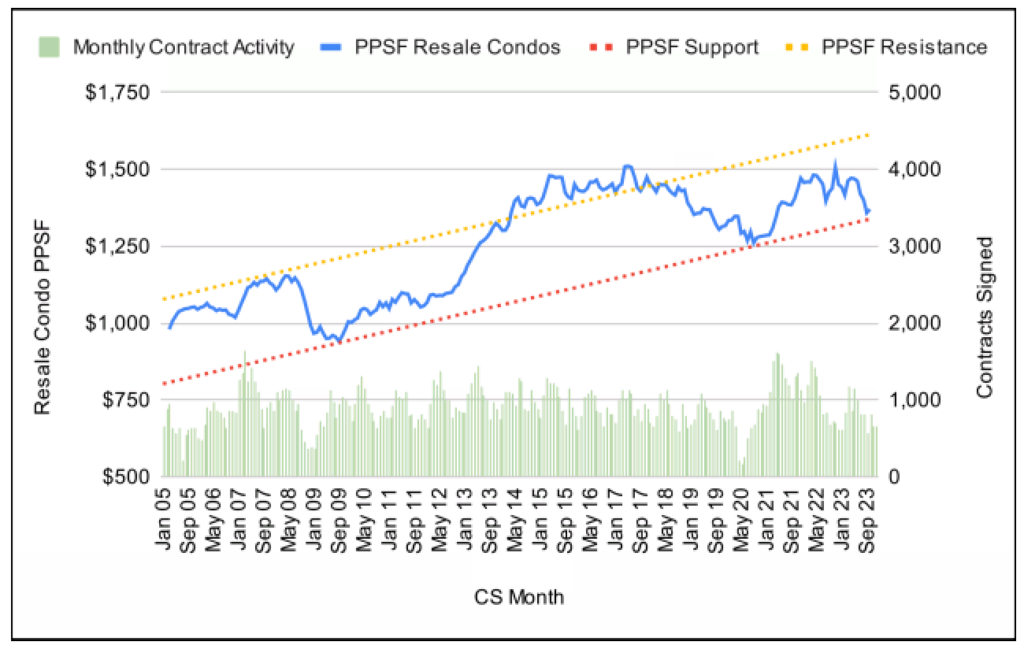

That was 2020; more recently, in the Spring of 2022, the war in Ukraine had already broken out, supply chains were still sticky and interest rates were on the cusp of the steepest rise any of us have experienced in our lifetimes, 3% to nearly 8%…over double. As a result, deal volume slowed substantially and has remained languid for the past very long 18 months now. Those falling dominos quashed demand; as a result, we had 27% fewer closings in 2023 than in 2022. In turn valuations softened (and for the most part pricing), by somewhere in the 8-10% range, according to Noah and John at UrbanDigs. See their price/sqft chart below.

Click on each respective chart to expand. Courtesy: UrbanDigs

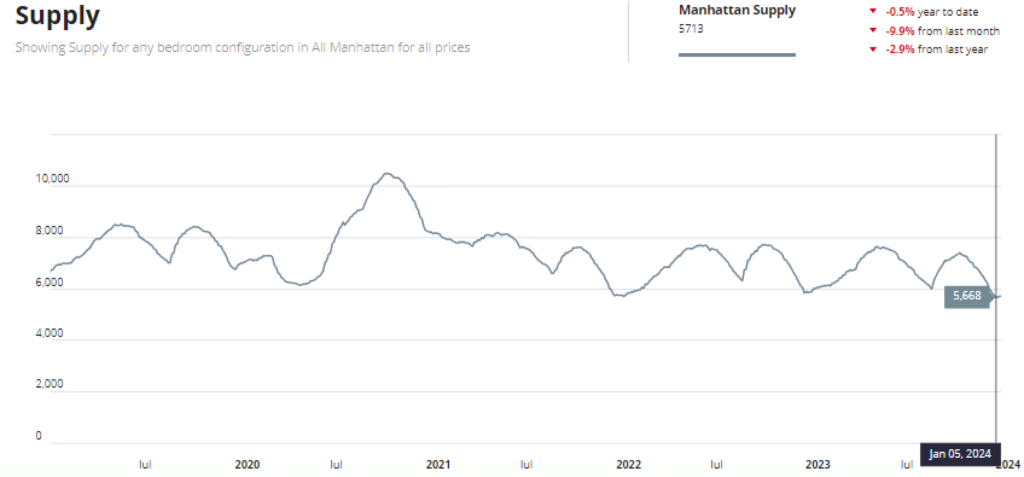

Consequently, we are quite literally in a Buyer’s Market, one where buyer leverage could even be stronger if the inventory levels were not so low. These low levels have served to actually support price levels from having fallen even more. See the inventory chart below which indicates that we are experiencing the lowest number of listings in nearly 5 years, but this is about to change, as we are in the beginnings of the seasonality of Winter when many listings begin to populate the marketplace.

My above forecast, predicting robust activity, could of course change, depending on the following factors:

A) How soon, and how often, will the Fed cut interest rates and how quickly will it translate to more favorable mortgage rates. In the last few weeks of December we already saw some lower rates and it is LIKELY to moderately continue.

B) Will these recent (and anticipated) interest rate cuts spur more buyers to come to market? – LIKELY, as sentiment has already improved.

C) Will the interest rate cuts encourage more sellers to enter the market? LIKELY, for the same reason as buyers; remember, sellers become buyers too. Sellers, knowing that interest rates will never dip to the level of their current mortgages, will acquiesce to a narrowing differential and see 6.5% interest rates as palatable/fair.

D) The forgoing will feed inventory levels and induce higher liquidity in the marketplace. FOMO will ensue…it’s the New York way…more and more people will jump in.

Conclusion: Overwhelmingly, brokers believe demand will be strong. People have been holding on tight, avoiding the extreme increase in affordability brought on by a move; however, life happens and they have to move (kids, 2nd kid, 3rd kid, kid goes to college, parent gets a new job, divorce…you name it). This will produce inventory and buyers will emerge. Which force will overpower the other, the supply of apartments coming on the market or the number of buyers looking, is yet to be seen. Regardless, deal volume will escalate and put pressure on prices to follow.

And oh yes, it’s an election year…and what an election year it will be. “Typically” it materializes into a “much ado about nothing” scenario. As we approach late summer, buyers become uncertain about what is going to happen politically; so deal volume temporarily slows or outright pauses. But, regardless of who wins, the moment the election is determined, the market continues on, as if nothing ever happened. There actually tends to be a bit of a bump immediately afterward, as the pent up pause that occurred works its way through. Question is, will this unique voting year be different?…Hmm…time will tell.

My take: For buyers, there is a wonderful small window right now, for the next 4-5 weeks which will likely prove to have been an extraordinary time to identify a good property. Conversely, Sellers can actually afford to be patient during this time period and prepare their properties for that moment when the marketplace becomes more active, mid/late February and into the Spring. But don’t sit around, literally prepare it for market…declutter, paint, detail, stage, get great photos etc.

I always say: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.

Any chance we can get the cliff notes?

So is the price right now for buying or are prices going down?