Right now it’s musical chairs in an auditorium with ample seats, no immediate urgency, as the real estate show we have been watching has been mediocre, at best. As I described previously, it was “The Great Pause”. We always have a summer lull; however, it was overwhelmingly magnified by everyone’s exhaustion brought on by the negative market dynamics including, but not limited to: the war in Ukraine, explosive inflation and the mixed messaging on how to manage it, the rapid rise in interest rates, the uncertainty of the coming mid-term elections* and more. Sentiment has been tepid, at best, as we come off 2021’s record deal volume; a phenomenon we are not likely to see again in our lifetime. But know this, John Walkup of UrbanDigs said it best, “we are crashing back down to NORMAL.” This is great news, as it means a more balanced market for every for everyone.

All charts: Courtesy UrbanDigs

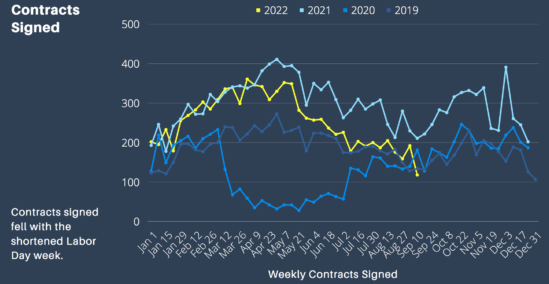

As you can see above the overall total pace of monthly contracts is indeed lower than the record volume we saw in 2021, but still substantially above pre-pandemic 2019. So even with all of the negative factors which we’ve endured, the market is healthy. However, if you glance at the most recent trend in the next chart below, you will see how the market is decelerating, a representation of a slower market and an opportunity to negotiate as we lead into the Fall season.

* The uncertainty that is always brought on by the mid-term elections and, even more so, by the Presidential elections is always much ado about nothing. I have been through innumerable market cycles in my 24 year career and they always amount to nothing except wasted time and opportunities. Deal volume becomes languid, as people fear what might happen. You know what happens?…nothing. Life moves on; people: have children, children leave the house, they get new jobs, get divorced, need to change neighborhoods etc. Had they not put their plans on hold and bought during the “uncertainty” (a difference of only a few months), they would have been far better off.

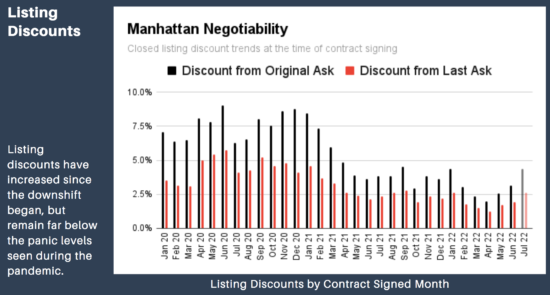

My experience tells me you should “Buy Now, Sell Later.” What I exactly do I mean by this? The market dynamics now, for buyers, are far more favorable now than they will be in the Spring. The past months have revealed a weakening in the marketplace, which sellers cannot deny. The numbers will soon trickle in to reveal where actual value has settled and it will be measurably below where we were when entering 2022. The only closed prices we have been seeing are from deals that were struck 4-6 months ago when prices were higher; the lower valued closings are now beginning to filter through. The sellers who want to sell must capitulate to this reality; this is favorable for buyers. Yes, interest rates have gone up, but by relative historical standards, not absurdly so (look at the historical rate chart in this newsletter, below). You can always refinance (at a lower rate) later; but you can’t reprice later?

Two things for buyers: 1) Typically your biggest barrier to purchase is the competition, not the price level. So while many will be sitting on their hands in uncertainty, identify your opportunity with fewer people in the room. Buy when others are not. 2) By Spring of 2023 (barring any unforeseen geopolitical event), I predict this marketplace is going to be on fire. This will be the moment when everyone has accepted the new realities and new normals of interest rates and inflation (both of which will likely have moderated). They will all then be willing to (and have to) move on with their life’s needs. It will be pent up demand. This is when the real estate show becomes really interesting and the game of musical chairs gets really tough. Remember what it felt like before assigned seating in a movie theater and you arrived late?…trying to find a seat? That’s the worst, nothing left…and that’s how it will feel. Every Manhattan lull is the precursor to a substantial run; we are in a similar moment right now.

For sellers, this is where the “Sell Later” comes into play. If you can wait, sell in the late-winter/early-Spring when competition will be explosive and you will have far more people looking and competing for your property. If you don’t sell then….well, you are simply overpriced. Overpricing helps sell other people’s property. Manhattan is an extremely efficient marketplace, it is all about price. Prepare and plan in advance…do it now. If you want to properly bring your property on the market by the end of the Q1 2023. You will need that time and meticulously strategize the right presentation of your property to the marketplace. And price it right…get in and get out…that is how you will best succeed. When you establish a price, you are establishing an expectation; will your buyers be encouraged or discouraged by what they encounter.

Please contact me to discuss anything and everything…inflation and interest rate expectations, inventory, pricing, timing, the rental market, preparedness etc.

As you know, I always say two things: 1) Anyone interested in buying or selling, should be rolling up their sleeves to determine whether the time is right to sell or if there’s a home/investment property out there for them; and 2) Who represents you matters…your best investment is often in the broker you choose; find someone with experience, who you feel you can trust.

ROBERTO CABRERA, CNE

Licensed Associate Real Estate Broker

Brown Harris Stevens Residential Sales, LLC

1926 Broadway, New York, NY 10023

Direct: 917 – 906-0554

Email: rcabrera@bhsusa.com