Dear Subscriber,

Welcome to the eighth edition of our West Side Real Estate Market Bulletin, featuring this month’s major issues:

- Kevin McCarthy’s Speaker of the House impact on our local real estate market

- the status and outlook for inflation in our local market

- the status and outlook for mortgage interest rates in our local market

Market Summary

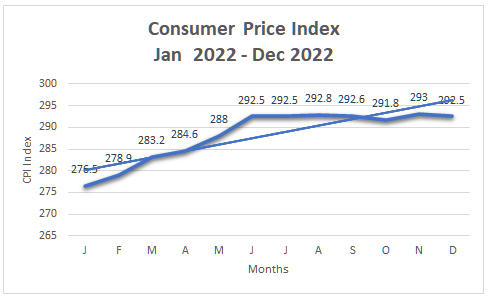

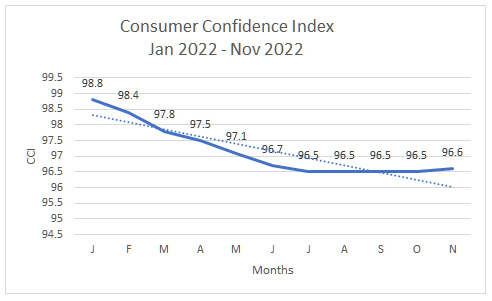

Our inflation rate remains high at around 7%; mortgage rates remain high also, and apartment prices continue to drift south. A recession is likely according to a majority of economists. From right-leaning Republicans we can expect major cuts in federal budget items like taxes, entitlements and infrastructure, aggravating recessionary pressures which are already significant. Please note that consumer prices remain at a painfully high level (”Consumer Price Index” graph) and that consumer confidence in the economy remains at a low point (”Consumer Confidence Index” graph).

Inflation

So far in the past year, in a strategy devised to tame inflation, the Fed has hiked up interest rates an unprecedented four times. As an unwanted but consequential side effect, economic growth has been hobbled by the increased cost of borrowing, and so far no substantial dent has been made in inflation.

What do the tea leaves say?

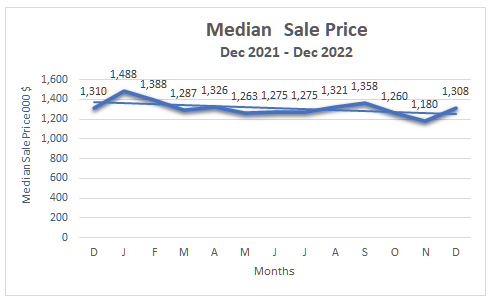

For our purpose the tea leaves are the graphs of UWS “Median Sale Price” and “Supply (Open Listings)”. Both of these key metrics indicate a continued price softness for the past year, and imply that sellers are reluctant to offer their properties during periods of depressed pricing. Conversely, sellers who list in down markets may be forced to do so by unfavorable circumstances and therefore may be more willing to negotiate.

Want to do a deal?

Are you considering buying or selling an apartment this year? If so, you probably know that we’re facing an uncertain economy which could turn against your best interests with little or no warning. But, some very good deals can be scored in a down market providing that one is vigilant, resourceful and adequately prepared. If you’re interested in learning more about this option just click on the link below to review methods for identifying and transacting exceptional down market deals.

Thanks for your interest and stay tuned!

Data courtesy of Urban Digs, Bureau of Labor Statistics

Will our nyc real estate taxes drop based on the market or the city will continue to increase the market value of our condos and coops so it becomes unaffordable for middle class people to stay in the UWS apartments ?

Above-inflation real estate tax increases are how the City funds a budget almost as large as Florida’s state budget for less than half the people.

Don’t be naive. RE taxes will never drop — after all, we’re all rich!

As an owner of two residential buildings on the UWS, I’m worried.