As small businesses die out all over New York City, the Upper West Side just staged the ultimate comeback story.

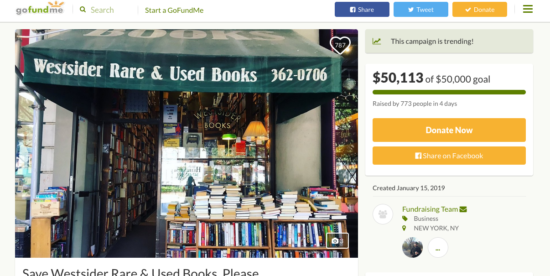

A fundraiser for Westsider Books on Broadway between 80th and 81st Streets hit the magic number of $50,000 on Sunday, meaning the bookstore now plans to stay open. Just last Monday, owner Dorian Thornley had said the store was closing because business had been slow.

“I’m so excited that we’re still here and the community will live on,” said Olivia Lucas, an employee at the store. Thornley was not there but texted “PARTY!!!” to Olivia when the fundraiser passed $50,000.

The gofundme campaign, started by Bobby Panza, raised money at a fast and furious pace. Panza’s campaign began with a comment on West Side Rag, but the story quickly picked up steam, getting attention in the New York Times and other media outlets. People who donated left comments on the fundraiser like the ones below about how the business was crucial in their lives:

Feed the hungry.

Hooray. So glad. Thanks for your help in this.

great news indeed….YAYYY!!!!!

WE HAVE TO KEEP SOME OF OUR LITTLE SHOPS ALIVE IN OUR NEIGHBORHOODS 🙂

This is a wonderful story but with UWS businesses being driven out by the greed of landlords and misguided tax benefits, Will do little to cure a problem legislators have done nothing substantial to address. What will happen to the next dozen small businesses that face the same fate? Will Individual fundraising efforts happen for them, too? Or is it just a problem when the business has had longevity and sells the nostalgia of used books in a digital age?

I hope my neighbors will keep up this generosity, because with the new $15 minimum wage coming in, every single mom & pop establishment you’ve ever patronized or even just walked past will be out of business within a year. Unless of course you’re willing to pay $8 for a plain bagel (cream cheese extra).

Open those wallets!

A. Smith nailed it. Forcing economic prices via mechanisms like minimum wage never work in the long run (just look at the extreme example of Venezuela). While yes, it is nice for workers to make more money, if their skills are valuable, they will be able to command more pay at another business. Especially during this time of record low unemployment. But it’s simple math – if it costs more to pay a worker, prices have to rise to compensate. The only two alternatives are automating the jobs or closing the shop.

Third alternative: tax the city’s billionaires and multimillionaires at a higher rate to pay for stuff everyone needs but no one can afford (with $12/hr jobs that prop up the “record unemployment” stats).

Simple math: get it from the people who got it.

That’s called Communism. Also called government-forced theft.

Nope…Eisenhower wasn’t a Communist. But one could call the 2008 bank bailout (including at least one non-American recipient) government-forced theft.

Yes, but if you go too far, those people will leave. You have to be strategic.

Very true. “Strategic” is important.

What a travesty… workers making a living wage.

Apparently a. smith has never read Adam Smith.

Hi Bruce

As always, you have proven to be very generous with everyone else’s money (but extremely stingy with your own).

This business is dying and dependent on donations to stay alive a few more weeks. It can’t meet its current expenses. How is it possibly going to afford to pay a $15 minimum wage?

Perhaps you should donate more money so this bookstore can meet its new bloated payroll.

Sherm

Sherman,

Apparently you don’t understand capitalism. I would urge you to read Adam Smith. You could follow that up by reading a little Marx, but I know that is too much to ask.

Paying workers a living wage is not “giving away someone else’s money.” it is giving fair compensation for the labor they invested in the enterprise. Adam Smith, by the way, subscribed to a version of the Labor Theory of Value, which posits that ALL the value in the enterprise was created by the labor.

As I’ve pointed out before, the issue at hand is how the revenue generated by the enterprise is divided among labor, capital (the businesses owners), and land (the landlords). This is Adam Smith 101. the landlords should get the smallest share. I dare say (just an educated guess) that in this case they are getting the greatest profit.

It’s interesting how you whine about workers getting a measly $15 an hour, but always defend the exorbitant rents of the landlords. Possibly you think the rich are not yet rich enough, and the lower middle class and the poor are not poor enough?

Sherman,

yes, you are personally attacking me as “entitled” and “a crook.” it wasn’t very subtle.

very nice.

you didn’t dispute any of my remarks about Adam Smith. Which, of course, you can’t do.

And you also don’t understand either “entitlement” or “crooked dealing.” I’m proud of what our tenant association accomplished, and it was totally legal. i guess you think the only people who can ever benefit from a negotiation are the very rich and privileged, not people of modest means who benefit by sticking together.

Since you personally attacked me — in a very vile way — i think i’m justified in returning fire: you are an angry, bitter, apparently jealous man who seems to despise those around him except the richest and most powerful. I have no idea why. i suppose i should have empathy for your obvious pain.

Hi Bruce

I think I know a tad more about Adam Smith and – as much as I hate to admit it, Marxism – than you.

Furthermore, using your deranged logic perhaps the people who have high disposable income due to their rent entitlements and crooked insider apartment purchase deals should pay higher prices at neighborhood stores in order to support them.

Get my drift?

Sherm

LOL – yeah, after decades of small businesses being destroyed by high rents (only to see the former business sit vacant for years), lets prime people to blame future evictions on the minimum wage!

Incredible.

Would be nice if Starbucks on W. 76th Stays open.

You should start a gofundme

A GODSEND TO JUST HAVE

Awesome! Though what happens now? How much time does 50K buy? What does the owner plan to do with it?

“Just last Monday, owner Dorian Thornley had said the store was closing because business had been slow”

Kicking the can won’t solve the issue, unless there is a revised business plan.

Minimum wage issue is a red herring.

Also, a building owner may have a family too.

I hope this wonderful news has been shared with the New York Times, the Wall Street Journal and every news outlet. It shows the power of the people to get things done about things they care about in their communities! Bravo to all who contributed! So proud to be an upper Westsider!

Hallelujah!

Yay!! Now I will look forward to my trip north to the US in March!!! Otherwise, my predilection is to just hop a train and leave the neighborhood.

I can’t help but wonder what will happen to this bookstore once this $50K runs out.

Donations are not a long term solution towards saving a failing business.

That’s good news, but not very clear. How long will $50,000 enable the bookstore to stay open? One more month? Two? Three? Anyone? Anyone? Bueller? Bueller?

You already know the answer.

This was a way for a few people who don’t want the world to change to feel better about themselves for a few minutes, then go back to shopping at Amazon.

to those who are skeptical this infusion of funds will do anything, i say it goes beyond the $50k

people will be more aware and make more of an effort to shop there. i personally also have decent books i can give them on a regular basis which they could make a few bucks from.

I am happy for them and people are free to do with their money as they wish, but I can think of much better uses for $50,000 of charity than that. Like helping some of the underperforming schools in the neighborhood that everyone normally is so concerned about. Or feeding those who have little or no food. Or helping out federal workers who are being held hostage and struggling to make ends meet. Or supporting programs to replace the neighborhood library that will be closed for over a year.

Juan, those are all good things – but why are they better than saving a store and the jobs it provides?

As an aside, I wonder if the owner will be receiving less than he thinks… tax-wise.

Go fund me money could be a tax-free donation to the recipient… but, since this seems to be a business rather than personal issue… there may be income and payroll taxes due. I think the IRS definitions are somewhat blurred

The donations to gofundme are definitely NOT deductible for tax purposes. Only donations to 501c3 organizations are deductible for tax and this bookstore is not this type of organization.

However well-intentioned the donors might be not one penny of their donations are tax deductible.

And yes, the funds received are taxable income to the bookstore.

First of all the only persons worried about tax deductibility of charitable donations are those who itemize on their returns. That lets out nearly a great majority of US rate payers as they take the standard deduction.

Two, as noted in my other post what the company does with this money and or how the donations are treated will affect how or if they are taxed.

If money is given entirely without any expectation of quid pro quo (not an investment, no gifts or other considerations of any sort expected in return, etc…) then the funds *may* be just that, a tax free donation.

Whoever organized this must know this, but to me (I donated), the FIRST FIRST FIRST step is to convert this entity to a non-profit.

Do you understand the difference between a for profit and not enterprise?

If the owner of Westside Books is having difficulties making ends meet as a for profit enterprise, how is he going to make things work as a charity?

In case you’ve not noticed plenty of thrift shops and other retail owned or whatever as part of non-profits have closed and or would up entirely over past several years. Goodwill on West 79th is one example.

Not for profit is sort of a misnomer as such ventures are supposed to and need to earn profits. Just that with such a charity designation excess funds (profits) are supposed to be reinvested back into the entity in support of their charitable mission.

Saint Vincent’s hospital was a non-profit, and look what happened to them.

Are you sure? They are a gift to the owner. I did not think gifts were generally taxable income to the recipient. (I’m not a tax accountant though.)

WestSiders are beautiful!

Excellent. I am a Long time customer

We DID it!

Now, let’s do something else important.

While I certainly recognize the donor’s generosity I can’t help but see this as merely kicking the can down the road for the troubled business. If the donors were so willing to give money to keep the store in business then why wouldn’t they have just shopped there and spent the same amount thereby legitimately sustaining the business? Doesn’t make much sense to me but it does highlight the notion of its more convenient to order things (or donate to gofundme!) from the comfort of my own home than it is to physically shop at a store. See the connection?

First, GoFundMe will take a cut off that $50k in donations.

As a for profit company GFM takes 5 percent of donations raised on its platform. There is also a 2.9 percent payment-processing fee collected on each donation, along with 30 cents for every donation.

Crowd funding sites are required by law file a 1099 reporting all revenues where accounts received more than $20k and or had in excess of 200 donations.

Generally such dontations are considered personal gifs and not subject to taxation by recipient.

However as with anything else dealing with US tax policy things can be complicated. So rather than make a very long and boring post, read here: https://www.brinkersimpson.com/blog/tax-consequences-of-crowdfunding

While one supposes this is a good thing for Westside Books, one does question how far (and for how long) this generous infusion of cash will keep this business afloat.

After blowing this wad of cash unless something fundamentally changes with Westside Books business, they will be right back to square one sometime in future.

Think of it along lines of when a household finds itself falling short in their finances. Uncle Hymie or maybe Grandpa Sherman write a generous check to help get the wolf from front door. This however is a one off gift.

Unless the household increases revenue and or also decreases debts it won’t be long before that begging cap is out again.

I can’t help but feel this money would have been better spent if it was donated to local librairies and public service groups.

Amen. See my comment above. This campaign is a typical knee-jerk UWS reaction to a situation. I am happy that the store is staying in business, I can think of many worse ways for people to spend their money and I generally don’t like telling people what to do with their money, but I know that inevitably half of the people who made these donations will soon be complaining again about the state of our libraries, schools, facilities for the homeless, etc.

I always thought I was a bleeding heart liberal until I moved to the UWS and started reading WSR…

Jeremy, you’re the voice of reason.

They should make this into a SUBSCRIPTION and DELIVERY service.

There are people on the upper west side who are interested in a basket of old books, and you pay $X and get books delivered to you. Or send iphone pictures of books you have to them and have them pick up and give you $.