By Carol Tannenhauser

The Small Business Jobs Survival Act (SBJSA) is a bill pending in the New York City Council intended to shore up small businesses and reduce the number of closings by regulating the commercial lease-renewal process.

First introduced in 1986, the SBJSA had its ninth hearing before the City Council Committee on Small Business on Monday afternoon at City Hall. In the prior eight hearings — the last in 2009 — the bill did not make it out of committee to the full Council for a vote.

It appears the ninth time’s the charm.

“This year’s version is expected to pass the Small Business Committee, as four of the five members — all except chair Mark Gjonaj — have signed on as co-sponsors,” Gothamist reported.

But in what form the final bill will emerge from the committee remains to be seen. Council Speaker Corey Johnson cautioned advocates against holding firm to their position that it be passed “intact,” as their signs read.

Gjonaj began the hearing by explaining exactly what the bill would do for commercial tenants in its present form.

“First, it would grant the tenant the right to renew his or her lease for a minimum of 10 years, and would set procedures for negotiating the right, including a mutual available option to seek non binding mediation. If mediation does not lead to an agreement with the landlord, the tenant may then demand final and binding arbitration.

“Second, if the tenant chooses not to renew the lease after arbitration, the law would regulate that he or she would continue to occupy the premises, while paying a rent that is no greater than 10% above the average rent that was charged during the final 12 months of the last rental agreement between the landlord and tenant. The landlord may then market the premises to a new tenant.

Finally, if the landlord reaches a lease agreement with a new tenant, he or she must offer the agreed-upon terms to the existing tenant. In that event, the original tenant is obligated to vacate the premises, only if he or she declines the new offer.”

Opposing the bill are those who view it as “commercial rent control,” and believe it would not reduce the problems of small businesses, but, rather, have “unintended consequences” (the catch phrase of the day) that would make their circumstances — and the city’s economy — worse.

That fear was first put forth by the de Blasio administration’s Commissioner of Small Business Services (SBS) Gregg Bishop, who testified that “we are concerned about potential unintended policy consequences of the proposed legislation that could make it harder for all commercial tenants, existing and new.”

John Banks, president of the Real Estate Board of New York (REBNY), was more emphatic. “We are vehemently opposed to this legislation,” he said, “which will do nothing to solve the underlying issues behind storefront vacancies and instead would have a catastrophic impact on our local economy…Failure rates have been consistent for decades — the average retail business survives less than 14 years— because there is always a new challenge. This decade the big disruptor is e-commerce, with a 50% increase in the online share of the retail sales market since 2013.”

Banks was supported by a cadre of commercial real estate brokers, one of whom cited stats from the Upper West Side. “I’m a commercial broker at Cushman & Wakefield,” said Steve Soutendijk. “My lifeblood depends on landlords and tenants coming to terms and agreeing on deals and filling vacant storefront space. We all recognize that this is a problem. However, landlords have already tremendously dropped expectations on retail rents over the last 18 to 24 months. Market rents — in every market, including the Upper West Side, specifically on Broadway — are down between 30% and 40%. There are just not that many tenants out there to rent all of the space available on the Upper West Side.”

Not so said David Eisenbach, a Columbia University history professor and leading advocate of the SBJSA. “I’m sick and tired of people talking about the small business crisis, but talking about everything but what’s causing the small business crisis. What’s causing high rent blight?” he demanded. “High rent. Astronomically high rent.”

David Eisenbach at a rally outside City Hall, with former Borough President Ruth Messinger in the background (in the purple jacket).

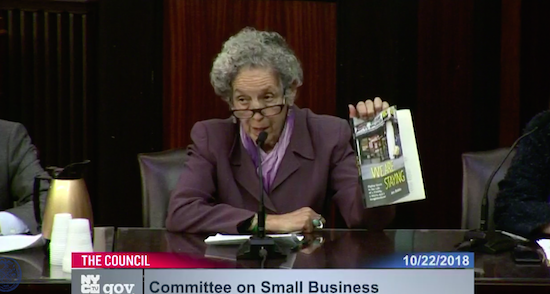

Former Manhattan Borough President Ruth Messinger, who introduced a version of SBJSA in 1986 when she was a council member for the Upper West Side, also testified. She mentioned longtime local business RCI, holding up the book “We are Staying” by Jen Rubin about her family’s struggle to keep that store going.

Ruth Messinger holding the book ‘We are Staying.’

Current Borough President Gale Brewer took the middle road in her testimony.

”While I agree fully with the goals of the SBJSA,” she said, “I have concerns about how effective the current version of the bill will actually be. As it is written, the SBJSA applies to all commercial leases, including thousands of white shoe law firms, hedge funds, and other financial institutions which do not need support. The scope of the legislation would first need to be significantly narrowed. Whether it should be narrowed to small businesses, small retail businesses, storefronters, or legacy businesses (long-term neighborhood businesses) needs to be studied, as does how those terms might be strictly defined in order to withstand a legal challenge.

“The Act must not be so cumbersome to implement for both landlords and tenants that unintended consequences arise,” she continued. “For landlords: will the regulatory burdens of the Act encourage them to sign up national chains that will always be able to pay rent increases, resulting in fewer opportunities for storefronters? For existing small commercial tenants who operate without a lease or month to month, the provisions of the Act must not increase the likelihood that they will be forced out.”

Brewer raised what Johnson reinforced: the SBJSA has a long road of negotiations ahead of it.

“It’s not reasonable to think there will be no changes to this bill,” Johnson said. “No bill happens that way in the City Council. I’m looking forward to having a constructive conversation with each other to understand where we think there is some wiggle room to still get to the heart of what this bill seeks to accomplish, while not overreaching in a way that will potentially harm small businesses, or help those that don’t need it.”

It’s absolutely shocking that our City does not step in

and regulate commercial rents in some way.

It’s actually altering the quality of life as our merchants

are disappearing

Another bad decision by our City, one bad decision after

another is altering the quality of life as we knew it the bike

lanes included.

Who is gonna want to pay 5 Mil for an apt. to live in a City

where the quality of life is deteriorating. Big overbuilders

beware.

You know what else is affecting the quality of life for so many Americans? Grossly overpaid individuals i.e. actors, professional athletes, CEO’s, Wall Streeters, the list goes on. Why don’t we legislate a cap on compensation any one individual can be paid? Maybe we can legislate how these savings are to be spent i.e. toward education, homelessness, veteran affairs, mental health…

Re: “Why don’t we legislate a cap on compensation any one individual can be paid?”

COMRADE! Where were you? We missed you at the last meeting of the UWS Communist’s Commune.

Your message shows that you TRULY ARE ONE OF US!

Please attend meetings. We serve Blini !

Dear Ivan Ivansky,

are you aware that FDR proposed a cap on incomes? it was during wartime… but still, i guess you would call him a Communist.

https://articles.latimes.com/1992-04-08/local/me-457_1_maximum-wage

And are you aware that the highest marginal tax rate for the entire Eisenhower administration was over 90%?

What a bunch of Communists Ike and Dick Nixon were!!

https://www.taxpolicycenter.org/statistics/historical-highest-marginal-income-tax-rates

This sounds like a bunch of lefty politicians pandering to their ignorant constituents.

I challenge any of the advocates of SBJSA to find even ten economists who believe this is a good idea.

Commercial rent control would be a disaster for NYC. This is a simplistic and irresponsible policy to deal with the numerous complex issues facing small businesses.

“Commercial rent control would be a disaster for NYC. This is a simplistic and irresponsible policy to deal with the numerous complex issues facing small businesses.”

Your whole argument against “Commercial rent control” has NOTHING to do with the SBJSA.

As usual someone fed you some red meat and you’re rarin’ to go!

The SBJSA. is NOT COMMERCIAL RENT CONTROL AT ALL, rather it is a bill that gives both parties rights in the lease-renewal process. It levels the playing field for business owners to negotiate in good faith with their landlords. It does this by mandating mediation between landlord and tenant, and if an agreement can’t be mutually reached, then a binding arbitration process will be used. The arbitrator is chosen and paid for equally by the landlord and tenant. There are no caps or government formulas setting the rent. In fact, government plays no role in the negotiation process; therefore, it is not commercial rent control, something New York City actually had successfully from 1945 to 1963.

Hi dannyboy

As always you’re very generous with everyone else’s money.

You’re clearly not very generous with your own money.

Sherm

talk about “simplistic”…

let’s examine Sherman’s frequently repeated claim that DannyBoy, and others who favor some form of protection for small businesses, are “generous with everyone else’s money.”

in this case, you have a dispute between the commercial landlord and the retail tenant. the commercial landlord wants to collect as much as possible from the retail tenant in rent; the retail store wants to keep as much of that revenue as possible.

Both Danny boy and Sherman can be said to be intervening on one side or the other, thus, perhaps, being “generous with other people’s money.” The difference is that Dannyboy is trying to PROTECT the less wealthy and powerful of the two parties. Sherman is trying to maintain the legal privileges of the wealthier and more powerful of the two parties. Thus Sherman is being “generous” with the money of the retailer.

Sherman might counter that, in this case, the small retailers are asking for special privileges and protections. That is true, but there are a vast amount of special legal privileges and protections, as well as protections of custom, that accrue to the landlord class. In fact, the landlord class has the largest lobbying efforts in the City of New York to defend and expand those privileges.

Often the defenders of large capital (the landlord and investor classes) try to paint the picture that their economic privileges and economic power are some sort of “natural right” or stem from a “natural law” of capitalism, and that nothing can be done to change this. This is a myth, is far from the truth, and in fact much HAS BEEN done in other countries and even in America in the past to curb the power and privilege of wealth and plutocracy.

Landlord power does not extend from the hand of god nor from the laws of physics. It extends from the laws and regulations that we have enacted, and it can be limited.

But Sherm, I AM generous.

But you prefer to hurl yet another insult to cover the fact that you just LIE about “commercial rent control’.

Your lies are apparent, and you can’t defend them. That is why you hurl insults against FACTS every time.

Welcome to socialist NYC and older peoples feelings longing for the horrid city days of the 80s. Serious question here which I see wasn’t addressed above: if you are essentially going to put a cap on the rental income a landlord can receive (socialism/anti free market/freedom of choice), will you also institute a cap on the real estate taxes they pay? That is the major expense all landlords have, and it’s only been skyrocketing in the past few years. If you don’t do that… expect no one to invest in the neighborhood and buildings to fall apart. Btw, I’ve seen this numerous times in the past, there is no “tax break” to keeping a storefront vacant. If you believe otherwise, please show me proof. Real estate taxes do not get forgiven or decreased because of occupancy of a storefront. And they must be paid whether the building is making money or not. Again, prove me wrong.

Ajz repeats the misunderstanding about commercial real estate tax increases. No matter how many times it is corrected, the myth pops up again from the pro-landlord crowd.

Commercial real estate tax increases are passed on to the tenant in a standard clause of the vast majority of commercial leases. thus, the vast increases in rents have nothing to do with commercial property taxes.

Apparently you do not have experience with commercial leases.

You realize that in most commercial leases, the landlord includes real estate taxes into the rent being paid by the tenant. Thereafter, if there are tax increases, the tenant is responsible to pay the landlord for its proportionate share of such increases in real estate taxes….

Interesting article. Seems very well researched and balanced. I cannot imagine the investigation and open hearing time that went into this. This was real work. Thanks WSR.

I’m not surprised by business owners wanting more insight into their future costs (i.e., rent), both short and long term. Have this would certainly help them in planning expenses year over year.

I’m also not surprised by landlords preferring an open and free market.

While I am not a business owner, I’m not convinced the proposal will address what I see (and noted in the article) as the genesis of the current problem – e-commerce and UWSiders preferring to cuts their costs and opting for 2-day prime shipping. Sure, I complain about the vacancies, but when Gristeedles charges 2x-3x for what I obtain for a minimum 50% off by going online, well those dollars add up.

I’m all for supporting UWS businesses, and will spend a little more to support my neighbors (read, I visit and purchase from Zingone Brothers almost daily) I just don’t want to feel pantsed.

I know nothing about this Columbia professor, except that he’s a professor at Columbia. My only question is this.

Has he ever run a business in his life?

Is it only businessmen who should decide the fate of our neighborhood? Perhaps only representatives of the Real Estate Board of New York (REBNY) should decide the fate of The Small Business Jobs Survival Act!!!!

In a parallel situation, do you also believe that only Very Serious People, like the Supremes, should be deciding the fate of women?