The rapid rise in rents on the Upper West Side appears to have slowed, and even reversed.

Streeteasy says that landlords on the UWS are offering a higher proportion of discounts than landlords in any other part of Manhattan, with discounts up 1.7% over last year. And data from real estate firm MNS shows that rents are down in the neighborhood on a year over year basis for all sorts of apartment types.

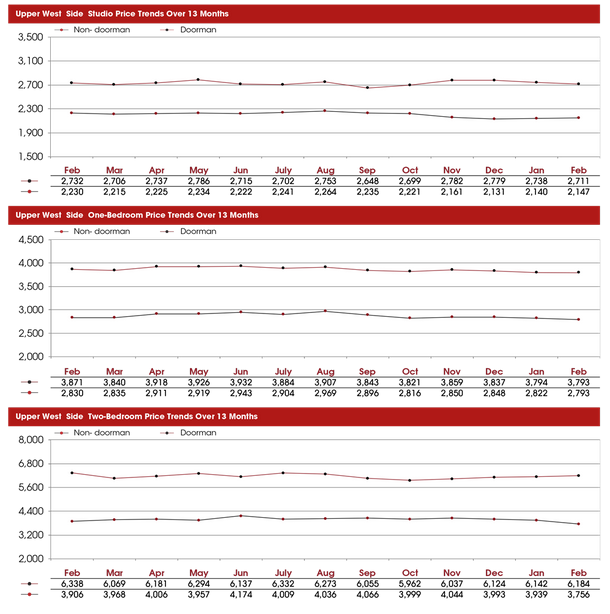

The table below shows the average monthly rental rate for several apartment types, from studios to two bedrooms, in buildings with and without doormen each month over the past year. In each case, the rents are down from a year ago.

Even after enlarging it, it’s hard to see. So here are current rental rates for each type of apartment for February:

- Studio (with doorman) $2,711

- Studio (no doorman) $2,147

- One-bedroom (with doorman) $3,793

- One-bedroom (no doorman) $2,793

- Two-bedroom (with doorman) $6,184

- Two bedroom (no doorman) $3,756

Still, the average apartment is renting for more money than the average Upper West Sider can reasonably afford in rent, using median rents and household incomes. Apartments are considered “unaffordable” if people need to spend more than 30% of their income on them.

No credits or acknowledgement to Jimmy McMillan?

This study is likely very misleading as it probably only includes market rate apartments rather then rent-regulated apartments (which are nearly impossible to obtain without hefty “key money” bribes).

In any case this study dispels the myth that “greedy” landlords can charge whatever they want for rent as there are clearly limits.

It also dispels the myth that new construction does not lower rents. (The last time I took an economics class I learned an increase in supply leads to a decrease in price).

Sherman–

If supply increases, that only lowers prices if

demand doesn’t increase.

But more and more people want to live in NYC (from all over the world.

This is why rents are so high, and have only fallen slightly.

It’s really not about “Greedy Landlords”

It’s just supply and demand. If demand is high, landlords will

charge whatever renters are willing and able to pay.

This is why so many people choose to live someplace else–

where demand is not as high: some parts of Harlem and the

Bronx, a few places in Brooklyn, some places in Queens may

be a better fit for what person can afford to pay.

Or they look outside the city & commute to a job in

NYC from New Jersey, Upstate N.Y, etc.

If you had taken a more advance economics class you would have learned that an increased supply does not always lead to a decrease in price.

“The last time I took an economics class…”

Was that the Economics class where your esteemed professor taught from the NYT Editorial/ Opinion pages?

By “impossible to find” you mean below to well under market rate rent regulated apartments, yes that I’ll give you. However there are plenty of RS apartments that go for $2k to $3k or more in this city.

If you look carefully many of those so called “affordable” RS lottery apartments aren’t exactly cheap either.

In both cases it is the perks that come with RS that cause persons to take such units even if the rents are on the high side. Basically once in it is nearly impossible to get rid of a RS tenant, and the increases are decided by the city.

Phase out Rent Regulation, return a THIRD of the housing stock to market rates. See how all of that extra housing supply will put even more furious downward pressure on rental prices. Provide NEED-based subsidies for those in need of affordable housing. This would go a long way to making housing more affordable in this city.

To see how far Albany is actually straying from “protecting the little guy Google “high income deregulation”. There is no reason private citizens should be subsidizing the housing of $200k earners, and indeed the general populace that share

the costs in higher rents that offset these subsidies. This is not economic justice.

“Phase out Rent Regulation, return a THIRD of the housing stock to market rates. See how all of that extra housing supply will put even more furious downward pressure on rental prices”

Like happened in Boston and Cambridge, right?

I mean, you DO know that you have a case study right there on the East Coast where rent regulation was abolished just twenty years ago?

You DO know what happened as a result, right?

Right?

You’re not just talking out of your sleeve?

Sloop–

What you are really saying is “return 1/3 of

housing to the market rates of the past.”

Those are no longer the market rates of 2018.

There are plenty of people able & willing to pay current rates.

That’s why rental apartments on the Upper West Side

don’t sit on the market for months.

Also, under rent regulation, many landlords were squeezed to a

a point that even the best landlords began cutting back on

maintenance,conforming to fire codes, making sure the heat was on when it truly became cold, etc.

In certain cases rent regulation hurt tenants.

And, unfortunately, a great many well-off families too advantage of rent-regulation to hold onto apartments at well below market

rates for years. I’ve known many people who “Inherited” a

rent-controlled apt., and paid 30% or 50% less than others

who weren’t lucky enough to come from a family that had

snagged a rent-controlled apt. years ago.

This also isn’t fair.

Maggie Mahar says:

“Also, under rent regulation, many landlords were squeezed to a a point that even the best landlords began cutting back on maintenance,conforming to fire codes, making sure the heat was on when it truly became cold, etc.”

In fact, in the vast majority of cases, the lawbreaking incidents you cite by landlords are examples of “landlord greed”, not landlord poverty or financial stress. you are repeating many myths about rent stabilized apartments.

According to official statistics from the rent guidelines board (https://www1.nyc.gov/assets/rentguidelinesboard/pdf/ie18.pdf), for 2016, the most recent statistics available:

— average rent for rent stabilized units in “Core Manhattan” (South of 110th on West Side and 96th on East Side) was $2,282.

— net operating income PER UNIT for Rent Stabilized apartments in Manhattan was almost $900 per month. this includes all operating expenses including property taxes, but NOT mortgage payments. If landlords are not making money on rent stabilized units, it is because they are over-mortgaged.

–Net Operating income on these units grew by 4.1% in 2016; this is as opposed to operating expenses, which grew by 2.4%

— this is the 12th straight year that Net Operating Income (ROI) on rent stabilized units has increased.

— From 1990-2016,rent operating income on Manhattan Rent Stabilized Units has increased 64% in constant (inflation adjusted) dollars.

— average maintenance on a Manhattan RS unit is $210 per month. that is hardly breaking the bank.

Much more common than landlords being financially squeezed are landlords WITHHOLDING maintenance and heat to force rent stabilized tenants out.

you’re right that rent stabilized tenants in general pay less. How does this hurt tenants?

Hi Maggie

I agree with your analysis. Unfortunately, there are a couple of obsessive posters on WSR who exploit this corrupt system yet ironically rant that everyone else but them is “greedy”.

Sherm

Hey Sherm!

Talk about a compulsive posters! You have now posted SAME COMMENT dozens of times. That is the very definition of “compulsive”.

AMD, you agree with Maggie. Must be when she wrote: “In certain cases rent regulation hurt tenants.” I guess she’s protecting those rent regulated tenants from themselves, huh?

You can read Bruce Bernstein’s factual analysis below, that concludes with “Much more common than landlords being financially squeezed are landlords WITHHOLDING maintenance and heat to force rent stabilized tenants out.

You’re right that rent stabilized tenants in general pay less. How does this hurt tenants?”

Thats why I moved to Harlem 2 years ago.

One thing to keep in mind is that not all of these high rent apartments are in brand new buildings.

You find plenty of fully or partially renovated apartments in older buildings that range from five floor walk-ups to tenements.

Problem for landlords is that those who can afford to pay market rate rents have *plenty* of other options these days. This includes brand new buildings packed with amenities. And more supply is coming online and in the pipework.

NYC is ten or so years into one of the largest housing construction booms of recent memory. Despite all the moaning and wailing not all this new housing is pure “luxury”. This new construction is also doing what happens in a normally functioning market; increases in supply are mitigating prices/rents.

Tell this to my landlord who’s requesting a 6% raise this year!

Well then you have the option of doing what other market rate tenants have done; move house.

Know on our block and elsewhere (from speaking with friends and co-workers), the only tenants who truly won’t move are rent controlled/stabilized. Others increasingly can and will move when they don’t like a rent increase and or feel they can do better for their money elsewhere.

reply to BB:

why is the rate at which people move a good thing?

just the opposite, i see the stability of rent stabilized tenants as something positive for building community.

In my building, the rent stabilized tenants are even MORE stable than the independent unit owners.

constant churn in the housing market reflects a cost to both owners and tenants.

Exactly right! My landlord raised my rent $25 upon my renewal. Thats less than 1% for me and I live in the heart of Lincoln Square in a “luxury building”. Not all landlords are greedy!

Take another look at your monthly rent bill. I expect your landlord doesn’t want you moving because of his greed.

“move house… Others increasingly can and will move”

Promotes transience, not people. This is destructive to communities.

Strains human relationships. Destabilizes neighborhoods.

Let’s talk about maintenance fees of almost 4000 a month,

Rent control laws aren’t ending in NYS and thus NYC anytime soon, that is just a fact. NYC has gone too far and deep down that rabbit hole, and the experiences of Massachusetts/Boston are a clear example of what will happen.

This being said a majority if not all below market RS or RC apartments in Manhattan and many other parts of NYC have tenants who are in their middle to late fifties and onto senior citizen age. Thus over the next thirty or so years those units will be emptied out as people die.

Once the above occurs then the largest block of “below market” RS units will be those created under various “affordable” housing schemes. Thus you see why this mayor and city council have been so keen on preserving existing stock and insisting on much of the newly built being “permanently affordable”.

Finally as have pointed out numerous times previously in these discussions, not everyone in a below market RC or RS apartment is living large.

Yes, there are those who can easily afford to pay more in rent. But you also have a good number whose rent takes 33% to 50% or more of their monthly income. The middle aged to seniors you see digging through supermarket or other rubbish bags are neither all homeless and or trendy “dumpster divers”. Rather after paying rent and other bills they’ve very small amounts left each month to live upon.

Also as have pointed out those living in certain co-op or condo buildings have *very* good reasons to want RC/RS to remain. This is because thanks to the bizarre way NYS/NYC property tax laws work such buildings are taxed as rental properties, not owned. Thus their rates are based upon comparable rental buildings in same street/area.

Scores of co-ops and condos on UES, UWS and many other pricey areas of NYC pay far lower taxes under this system then they otherwise would. It also explains why so many co-op and condo boards are against increased luxury rental housing in their area. If average rents go up, so do their property taxes.

The double edged sword of RS/RC units is that the system rewards longevity. People who land or landed a “cheap” apartment tend only to leave if not legally evicted, then by death.

On the face of things this might seem like a good deal, but you’ve many seniors and others with mobility, health and or age related issues stuck in fourth or fifth floor walk up apartments. They cannot move because anything else would likely cost more, much more rent than they can afford.

“People who land or landed a “cheap” apartment tend only to leave if not legally evicted, then by death.”

No Private Equity evictions, landlord evictions, phony buyouts, heating withheld, unsafe conditions, harassment, etc, etc, etc?https://apnews.com/002703e70347481cb993027d04f543cc