Detective Andrew Shore speaks at a 20th precinct meeting on Monday. Photo by Meredith Kurz.

By Meredith Kurz

“It’s not only tax season, it’s identity theft season,” explained Special Investigations Division Detective Andrew Shore at a meeting of the 20th Precinct Community Council on Monday night. “It’s the fastest growing crime in the world,” he went on. “The Federal Trade Commission statistics reveal that 9 out of 10 people will be victims of identity theft.” Detective Shore reviewed the techniques thieves use, and the strategies you can use to avoid being a victim.

During Tax Season there are two types of typical fraud. The first is that people steal your Social Security Number and file for your tax return and get your money. When you apply to the IRS with your true returned, you’re denied the file. If you file early you can help prevent this happening. Also, people will receive a call, allegedly from the IRS stating that they must pay now or go to jail. Senior citizens are the most targeted for that type of scam. The IRS will never call you and demand payment.

Try to limit who has your social security number, your date of birth, etc. “Your doctor’s office doesn’t need your social security number,” said Shore. Also, when you fill out the car loan form and they do a credit check, they’ll ask for your social security number. After they’re done with the credit search, make sure you see your information shredded or returned to you.

“Experian, TransUnion and Equifax credit reports will give you a heads up if someone is using your credit information. Check your credit on a regular basis for peace of mind,” advised Shore.

Skimming is a prevalent theft technique where your bank’s ATM will be compromised. There are little cameras that can see your PIN number and also a scanner. Also, if you’re in a restaurant and your wait staff takes your card in the back room, they could be swiping your card into a device that can hold information for up to 500,000 cards, which is then posted on the internet and sold in blocks.

Always be wary of the bank calling you and asking “We’re just checking your account. What is your Date of Birth or your Social Security number?” Don’t give that information out: first call the number that’s on the back of your bank’s card.

If you are a victim, notify the credit bureau. You will be put on a 90-day Fraud Alert, which will call you every time a charge is made. You can extend this for seven years. For more information go here: https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs.

Other local information was shared, including several initiatives: there was a cold weather homeless operation that placed several individuals safely inside, there were Senior Citizen initiative where officers shared information with seniors in meetings about pedestrian safety, and there were several summons and more coming for the book vendors and also an empanada-seller on Broadway.

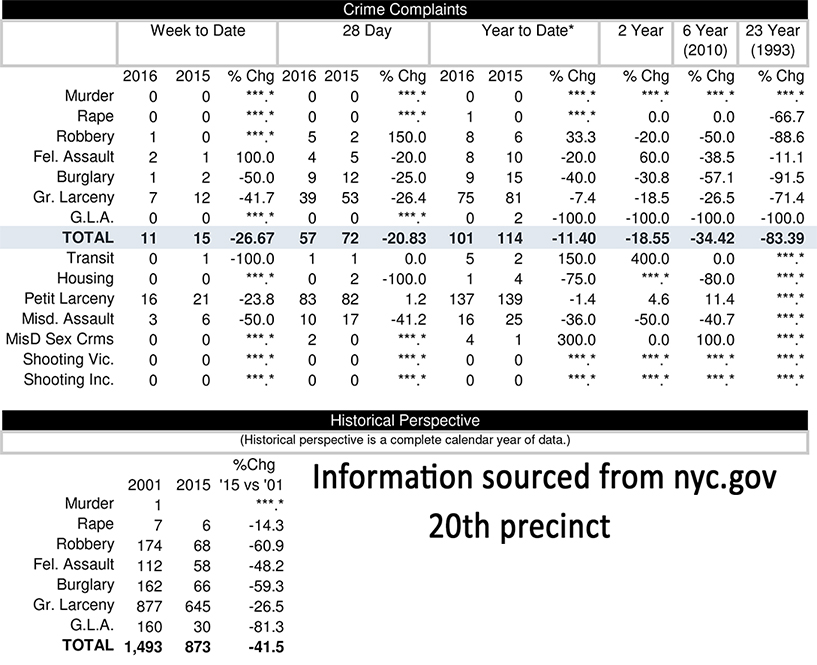

Recent crime stats for the 20th precinct (86th street and below) are below. Click to enlarge.

Doctor’s offices usually claim they need the Social Security Number for insurance.

They don’t.